Understanding ATM Cash Withdrawal Limits in Europe

Withdrawing funds from your checking or savings account through an ATM (automated teller machine) is a convenient way to get cash. However, it’s crucial to be aware of the withdrawal limits that may apply.

Many financial institutions and financial services providers enforce daily and per-transaction ATM withdrawal limits. These limits have practical and security reasons behind them. Let’s delve into how these limits function and why they matter.

Why Are ATM Withdrawal Limits Set?

ATM withdrawal limits serve practical and security purposes for financial institutions. Firstly, ATMs can only dispense specific amounts of cash, and ATM providers have a limited supply of cash on hand. Setting withdrawal limits helps them manage their cash effectively.

Secondly, these limits are designed to safeguard customer accounts. Imagine if your debit card and PIN were stolen. Without withdrawal limits, bad actors could fully drain your accounts. By enforcing limits, digital banking institutions add an extra layer of protection to your money.

How Much Cash Can I Withdraw at One Time?

Alongside a daily limit determined by your financial institution, specific ATMs might have their own restrictions per transaction. It’s important to note that daily ATM withdrawal limits can differ from daily purchase limits.

For instance, while your card’s ATM limit might be €300 per day, you might have a daily purchase limit of €2,000 using your prepaid / debit card. Some financial institutions keep ATM withdrawal and purchase limits separate, while others set a combined limit for both withdrawals and purchases.

What’s My Daily ATM Withdrawal Limit?

Your maximum ATM withdrawal amount depends on your online banking provider’s policies. Typically, ATM cash withdrawal limits range from €250 to €500 per day. However, this varies between providers, as there is no universal standard limit.

Factors influencing your personal ATM withdrawal limit include your digital banking history and the types of accounts you hold. If you’re new to your financial institution, your limit might be lower than that of a premium account holder.

Choosing the Right ATM

The higher your ATM withdrawal limit, the more cash you can access in one go. Suppose your banking provider has a €2,000 daily ATM limit. Regardless of the ATM you use, you won’t be able to withdraw more than that amount. Carefully review the terms and conditions during account opening to understand your ATM cash withdrawal limits. Pay particular attention to the fine print below the fees table.

I strongly recommend utilizing ATMs associated with well-established financial institutions for your transactions. Usually, using non-affiliated network ATMs can result in extra fees, particularly when you’re abroad. Alternatively, choosing card payments might be a more cost-efficient option, as the currency exchange fee at points of sale (POS) is typically lower than the cash withdrawal tariffs at an ATM.

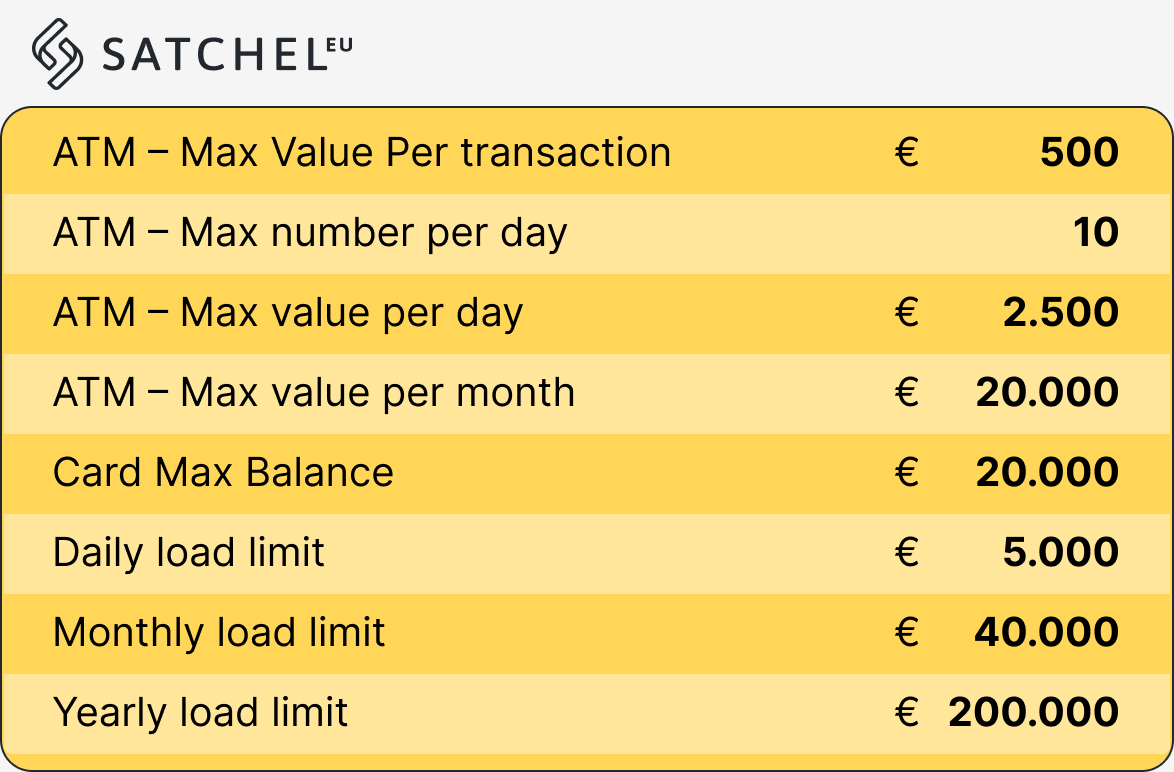

ATM Withdrawal Limits at Satchel.eu

Satchel.eu, a leading European digital banking provider, has a highly transparent tariff structure, free from numerous asterisks commonly seen in other plans. Satchel payment cards grant you the flexibility to withdraw cash from any ATM worldwide. To increase convenience, we’ve listed the key limits in the table below:

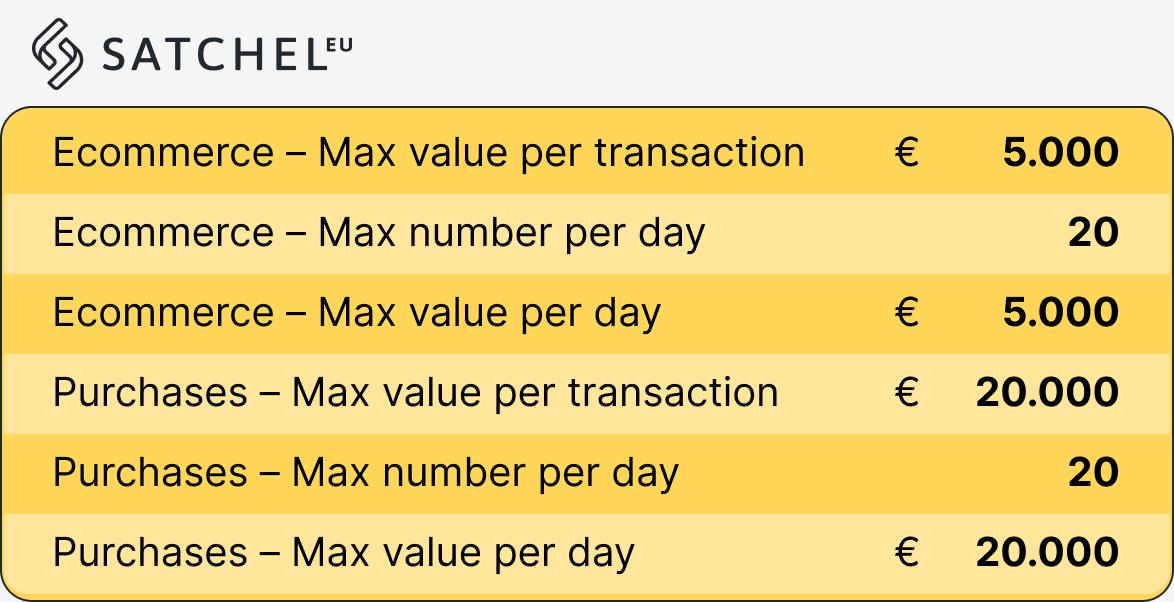

However, it’s advisable to consider the optimal approach – cash withdrawal or card payments – depending on your country of residence. Even if your card’s currency is the euro and you’re in a country that uses a different currency (for example, the złoty in Poland or the Swedish krona in Sweden), card payments are often more cost-effective. Check Satchel’s limits on POS/e-Commerce purchases:

It’s also worth noting that Satchel.eu holds the prestigious status of a principal member of Mastercard Europe for card issuing and was the first EMI in Lithuania to gain it.

Increasing ATM Withdrawal Limits

If you wish to increase your ATM withdrawal limits, a simple call to your online banking provider will be enough. Financial institutions may consider increasing your limits temporarily or permanently, depending on factors like your account history and the type of account you hold.

Keep in mind that higher limits are subject to security considerations. If you’re granted a higher limit, remain vigilant with your debit card to prevent unauthorized access to your funds.

Navigating ATM withdrawal limits ensures you have access to the cash you need while maintaining security. Whether you’re planning a significant purchase or a vacation, understanding these limits can help you manage your finances more effectively.