Ultimate account for your business

Get a unique European IBAN online and cover all business needs with Satchel payment cards.

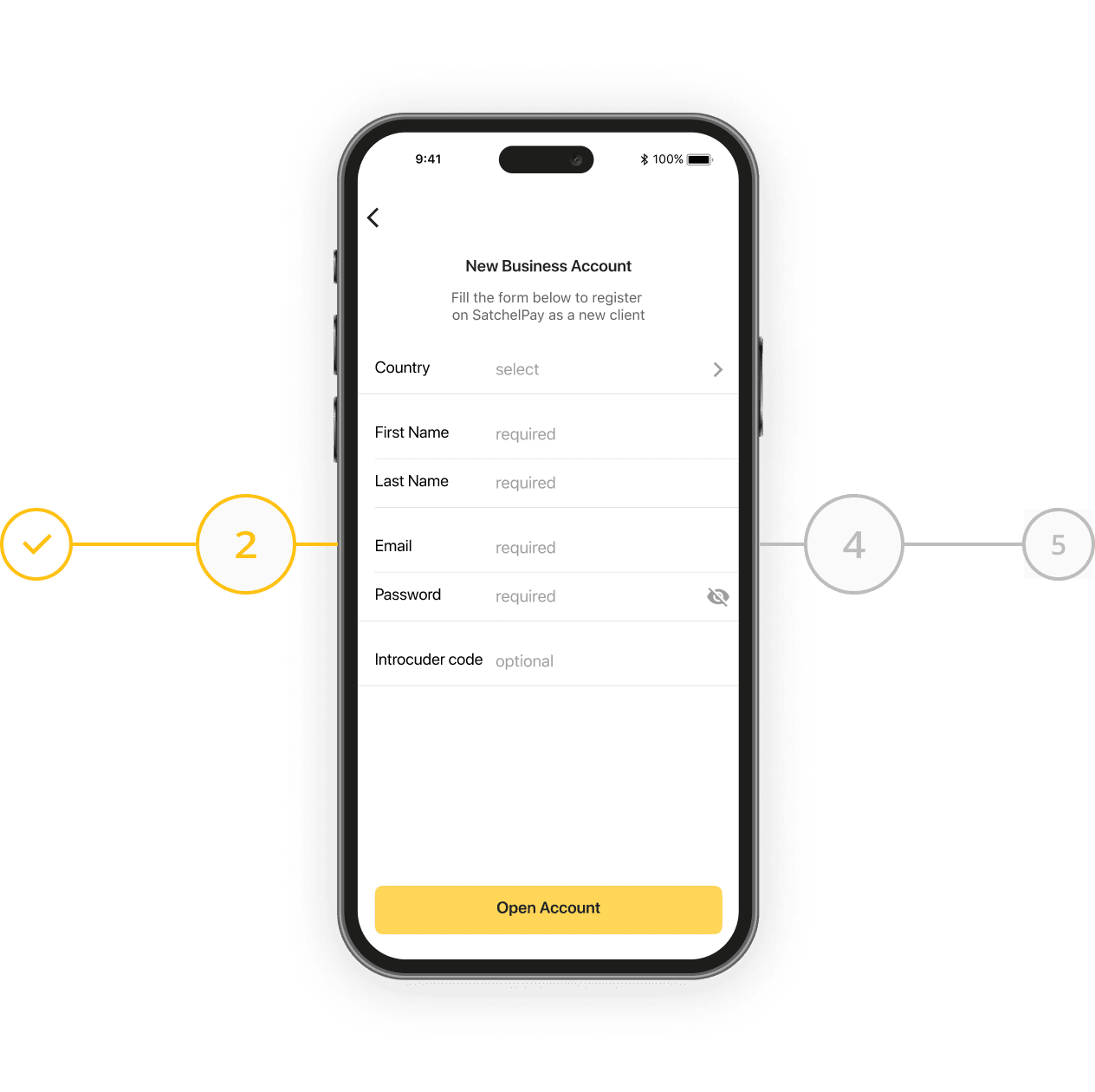

Remote account opening

- Unique European IBAN

- SWIFT and SEPA transactions in 38 currencies

- Simple online application form

- Personalised customer support

- Segregated account protected by the National Bank of Lithuania, with an added layer of protection thanks to 3D Secure and 2FA

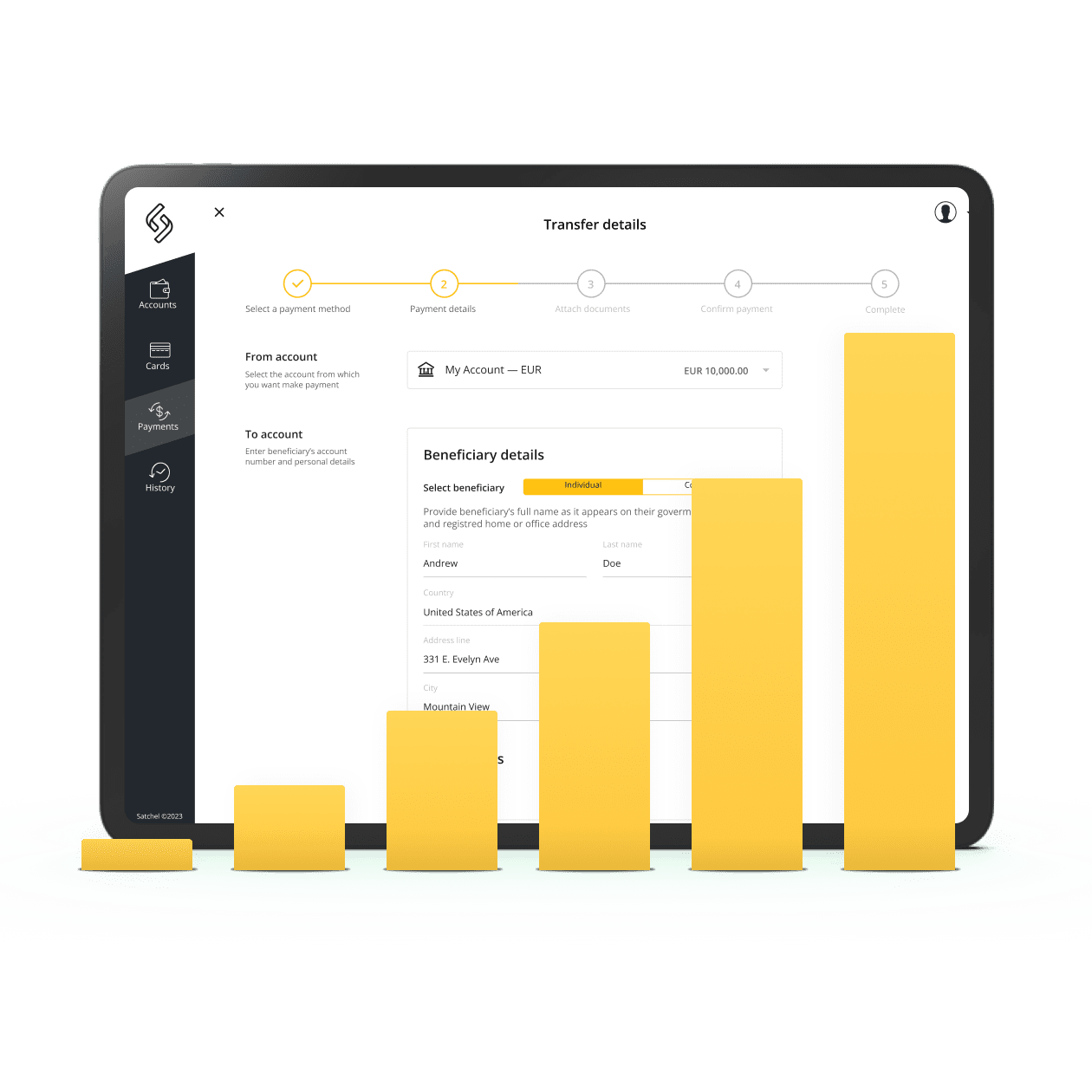

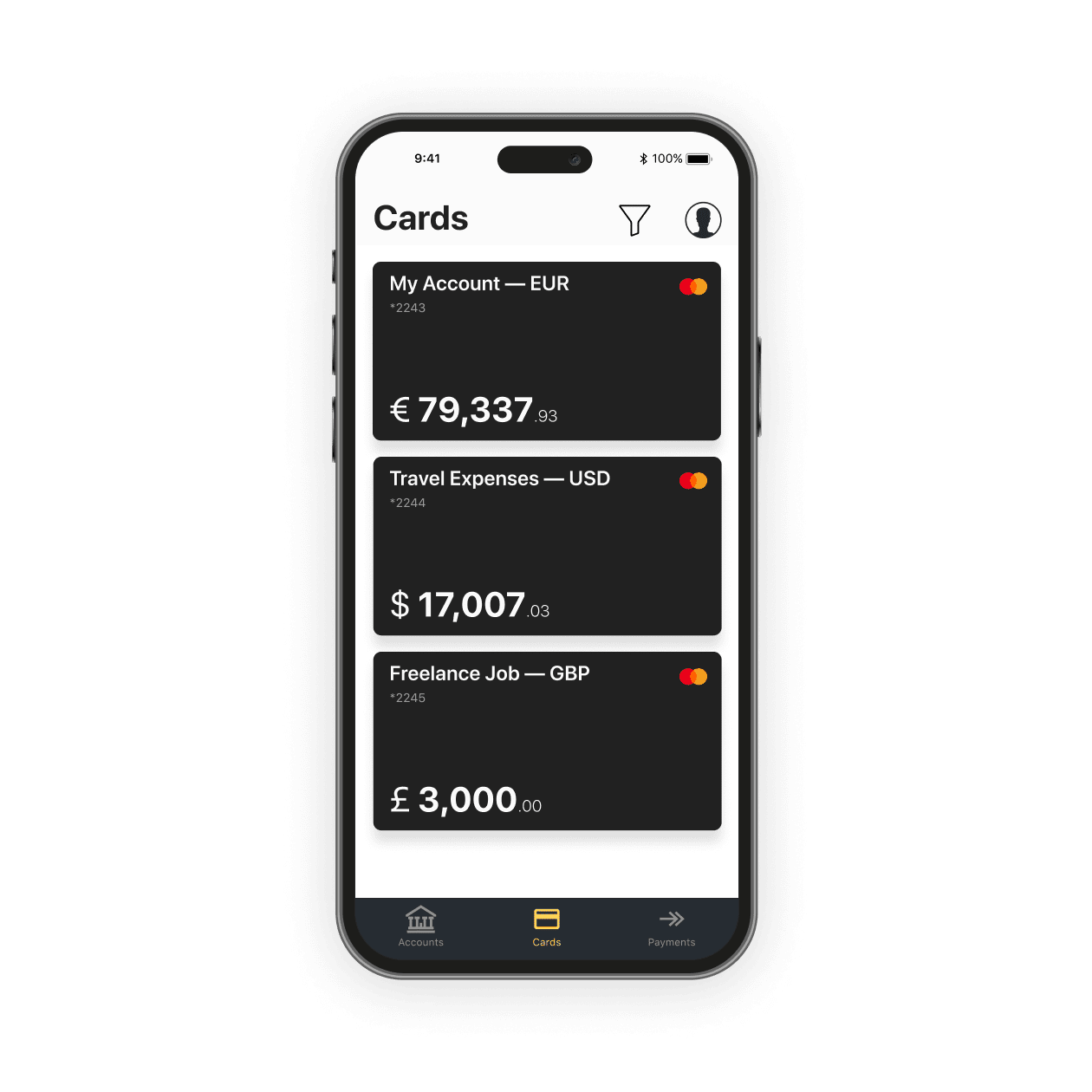

Payment cards for your business needs

- Physical and virtual cards for any purchases

- ATM withdrawals worldwide

- Tailor-made pricing

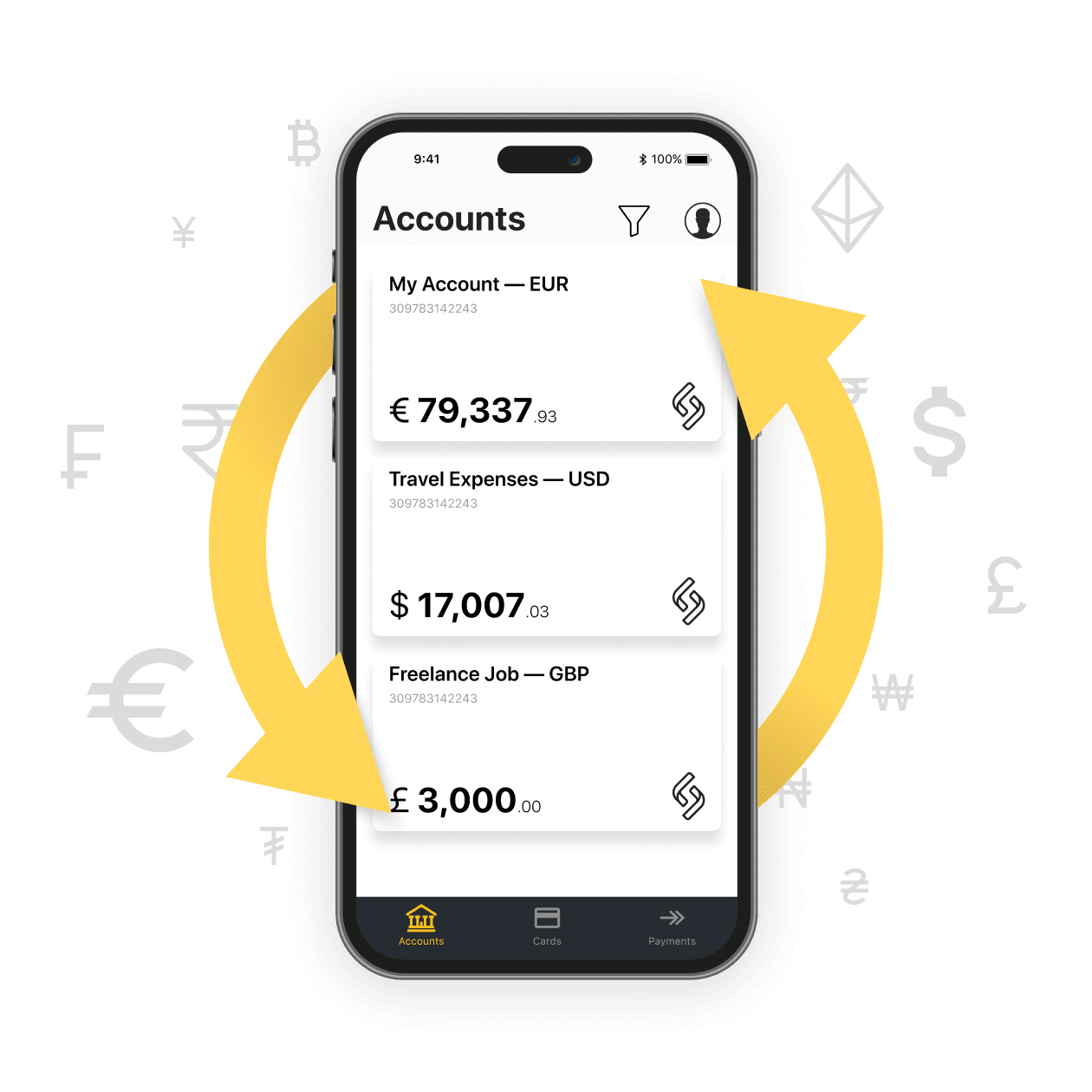

Multiple currencies for cross-border payments

Send and receive money around the world in 38 currencies with a multi-currency IBAN linked to your single account.

Payroll program

- Manage salary payouts and corporate expenses

- Issue from 3 to 100 cards

- Send batch payments with our API

- Make transfers directly from your Client office or the Satchel app

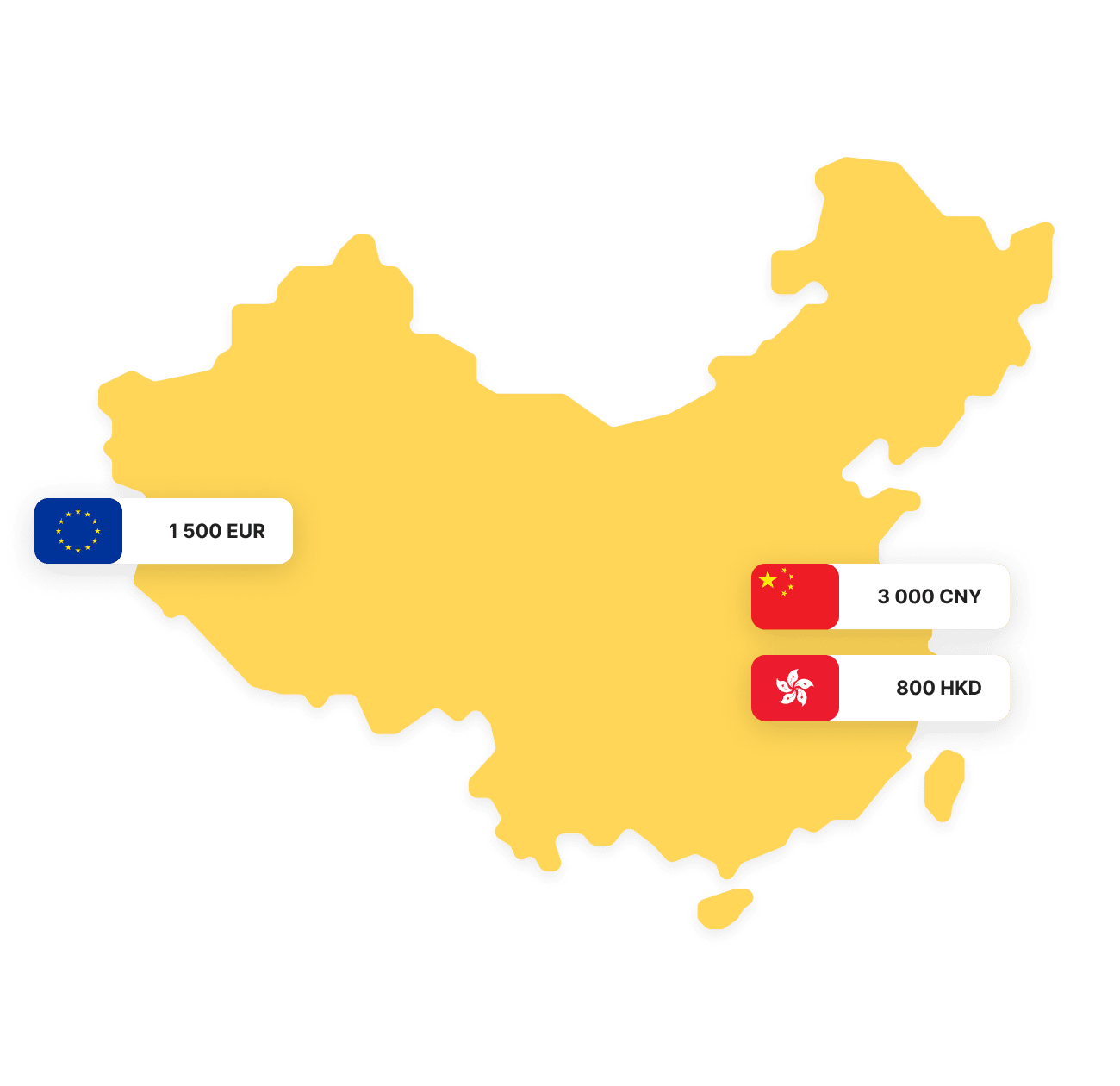

Discover the EU-China business direction

Expand your outreach to the Chinese and European markets by making transfers in Chinese Yuan and Hong Kong Dollar. EU and Chinese residents are eligible for account opening.

Debit Mastercard cards from Satchel

Link it to several accounts in different currencies

Pay in the currency of the transaction

Avoid currency exchange fees

Direct access to your funds 24/7

Choose the business account that suits you best

|

Local

LT residents |

European

EU residents |

International

non-EU residents |

|

|---|---|---|---|

| Monthly maintenance fee | € 4 | € 35 | € 50 |

| Additional account opening (sub-account) | € 50 | € 50 | € 150 |

| Instant transfers between Satchel users | Free | Free | Free |

| SEPA transfers (incoming) | Free | Free | Free |

| SEPA Instant transfers (incoming) | Free | ||

| SEPA transfers (outgoing) | |||

| SEPA Instant transfers (outgoing) | |||

| SWIFT transfers (incoming/outgoing) | |||

| Mastercard physical card | |||

| Virtual cards | |||

| Cash withdrawals across the globe | |||

| Mobile banking APP | |||

| In-app live chat support | |||

| All your money is protected by the Bank of Lithuania | 100% Secure | 100% Secure | 100% Secure |

FAQ

A business account is opened in the name of the company and is used for corporate transactions with suppliers, partners and customers, as well as purchases, bill payments etc. It also has a variety of additional uses, such as reporting, audit, salary payout and bookkeeping. Such accounts operate similarly to personal ones, however, business account holders can access services that are unavailable to individual users, such as:

- Foreign currency transactions

- Credit checks

- Payroll

- Credit line opening

Today, you can open a business account online, without the need to visit a bank branch and provide heaps of documentation. Check out this page for tips on online account opening for your business.

Satchel Business accounts are available worldwide. Since account opening applications are submitted and processed online, there are no geographic restrictions. Companies registered in any region other than blacklisted countries can open a Satchel account with a European IBAN. We recommend that you check the latest list of restricted jurisdictions before applying: https://satchel.eu/prohibited-countries-and-activities/.

Businesses registered in Europe, including the UK and Switzerland, as well as Latin America, North America, Asia Pacific, South and Southeast Asia, the Middle East, Africa, Oceania and the Caribbean, are all eligible to apply for opening a Satchel Business account.

To open a business account with Satchel, you will need to provide the following list of documents:

1. Online application form.

2. Copy of the business owner’s passport or ID (only for citizens or residents of the EU or the EEA).

3. Proof of address.

4. A detailed business description.

5. Corporate documents.

6. Supporting documents on clients/suppliers.

7. Documents with supporting information about initial funding.

8. Verification through the Ondato solution.

More information can be found here.

At Satchel, we offer business and merchant accounts. A business account is opened remotely and allows you to:

- Get a unique European IBAN;

- Transact in 38 currencies through SWIFT and SEPA;

- Enjoy personalized customer support;

- Cover all business expenses with Satchel payment cards.

You can learn more about the benefits of the Satchel business account here.

A merchant account is also opened online and allows businesses to accept multiple payment types, such as debit or credit cards. A merchant account with Satchel allows you to:

- Accept card payments in 20 currencies;

- Simplify your reporting process;

- Use APIs for faster integration;

- Ensure full security and compliance.

To open a business account with Satchel, you will be charged an account opening fee, which may vary depending on your company's jurisdiction, the residence and nationality of the owners, and the risk type of your business. The commission for opening a Satchel Business account starts from €4.00; you can find more details regarding the fees here: https://satchel.eu/fees/.

On average, most financial institutions require an initial deposit of between €5.00 and €1,000. However, at Satchel, we do not require an initial deposit and only charge an account opening fee if your application is approved.

Additionally, most EMIs have a monthly maintenance fee, which can range from €10.00 to €50.00.

Latest news and articles