Is a Private Account OK for Businesses?

Can I Use a Personal Account for Business Needs?

Using a personal account for business purposes is a topic that often raises questions and concerns among entrepreneurs. In this article, we will explore the circumstances in which using a personal account for business is allowed and when it’s better to choose an alternative route. We’ll also discuss the concept of a freelancer account and its advantages. Let’s dive into the details.

Using a Personal Account for Business: Yes or No?

When it comes to using your personal account for business matters, the answer is not a straightforward “yes” or “no.” Several factors come into play, including the nature of your business, your responsibilities, and tax obligations.

- Yes, it’s allowed for sole proprietors and freelancers

If you are a sole proprietor or a freelancer, using your personal payment account for business transactions is generally acceptable. This is particularly true when you need to receive payments or pay contractors or partners for services or products. However, it’s essential to emphasize that the crucial factor here is your responsibility to meet your tax obligations as a citizen of your country.

- No, avoid it for small and medium-sized businesses

On the other hand, if you operate a small or medium-sized business, it’s strongly advised not to use a personal current account for your business finances. Doing so can lead to complications and missed tax advantages, especially in most EU countries. Regardless of whether you have an LLC, Corporation, or Partnership, maintaining a separate business account offers numerous benefits, including legal protection.

The Importance of Legal Protection

When you establish an LLC or a corporation, one of the primary advantages is the legal liability protection it provides. The courts recognize the corporation as a distinct entity from its owners. By maintaining separate finances, your personal assets are shielded from liability, with some exceptions. However, mingling your finances can jeopardize this protection, potentially making you personally liable for the corporation’s actions.

Understanding Freelancer Accounts for Banking Online

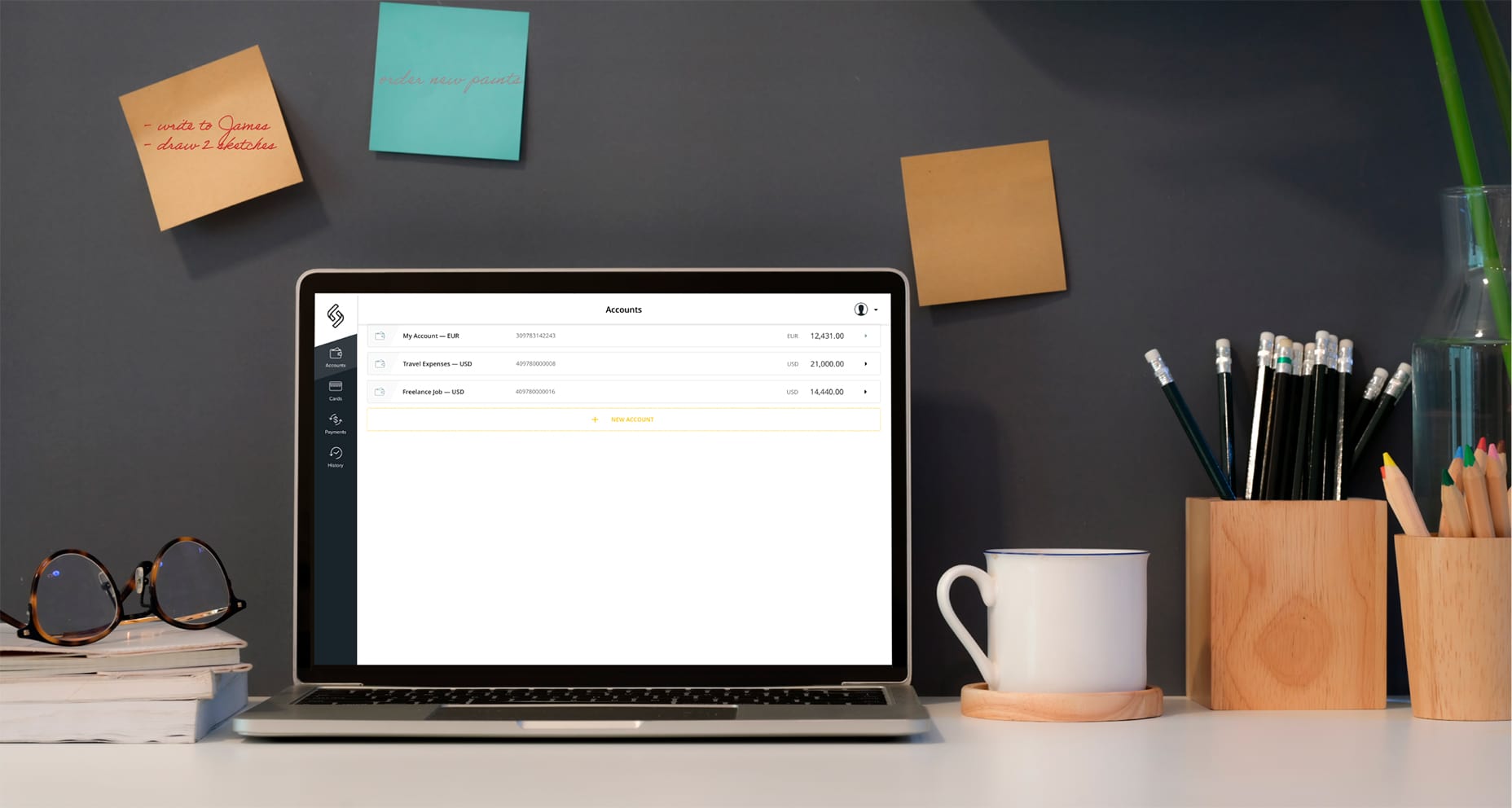

If you’ve ever searched for information on using a personal payment account for business purposes, you’ve likely come across the term “freelancer account.” This type of account is specifically designed for individuals who are self-employed or private entrepreneurs.

Advantages of Freelancer Payment Accounts

Freelancer accounts are current accounts for individuals aged 18 and above. They offer a notable advantage over traditional corporate accounts. The key benefits include fewer document requirements, simplified KYC (Know Your Customer) checks, reduced account opening and maintenance costs, and quicker processing times, similar to personal accounts. For instance, at Sathel.eu only 2 documents are required for a freelancer account opening online: a passport/ID card and a utility bill from your home country as proof of address. It is accessible to individuals coming from outside the EU/EEA: anyone can open an account remotely without leaving their home country. For Brazilian, British, Canadian, or Australian entrepreneurs dealing with customers or contractors in Europe, opening a digital account in euros at a European financial institution is a wise choice. This decision offers many advantages, among which saving on exchange rates, using SEPA Instant transfers for 10-second transactions, as well as getting digital/virtual payment cards.

In terms of cost and time, opening a freelancer account online is considerably more efficient compared to a business account. Freelancers can expect their accounts to be ready in 1-5 working days, while business accounts may take 3-4 weeks or longer, depending on the bank’s compliance processes.

What Can I Do With a Freelancer Payment Account?

A freelancer account typically allows you to perform various financial operations related to your business and personal finances. While the specific features and offerings can vary from one banking provider to another, here are some common financial operations you can do with a freelancer account:

- Receive Payments: You can receive payments from clients or customers for your freelance work or business services. This includes income from invoices, contracts, or online transactions.

- Pay Expenses: You can use the account to pay for business-related expenses, such as office supplies, equipment, software subscriptions, and other operational costs.

- Transfer Funds: Freelancer payment accounts often come with the ability to transfer funds between your accounts, whether it’s to move money to your personal account or to make payments to vendors or suppliers.

- Payment Cards: Every digital banking provider offers payment card options for your everyday payment needs, including online shopping. You can choose between virtual or physical (plastic) cards.

- Withdraw Cash: You can withdraw cash from ATMs using your account’s debit or prepaid card, allowing you to access funds as needed.

- Online Banking: Most banks provide online banking services, allowing you to check account balance, review transaction history or initiate new transactions, top up your cards, and set up automatic bill payments.

- Mobile Banking: You can access your account and perform transactions on the go through mobile banking apps, which are typically available for smartphones and tablets.

- Currency Exchange: Some freelancer accounts offer currency exchange services, which can be useful if you work with international clients or have expenses in different currencies.

- Receive Direct Deposits: You can set up direct deposit transactions for regular income streams, such as client payments or affiliate earnings, making it convenient to receive funds.

- Track Expenses: Many freelancer accounts provide tools or features to help you track and categorize your expenses, simplifying the process of managing your finances and preparing tax reports.

- Pay Taxes: You can use your freelancer current account to set aside money for taxes, making it easier to meet your tax obligations when they are due.

Additionally, some financial institutions may have restrictions or requirements for opening a freelancer account, so be prepared to provide the necessary documentation and meet any eligibility criteria.

In Conclusion

The decision to use a personal account for business purposes hinges on several factors, including your business type and tax responsibilities. While it may be suitable for sole proprietors and freelancers, it is generally not advisable for small to medium-sized businesses. Freelancer payment accounts provide a streamlined alternative with faster processing times and reduced administrative burdens, making them an attractive choice for many self-employed individuals. Ultimately, choosing the right account for your business is a critical decision that should align with your specific needs and legal requirements. But generally speaking, separating personal money from business funds is a good idea!