How to Open a Payment Account Online in Malta

Malta is a stunning island country. Relocating to this beautiful place is a dream come true! One of Malta’s great advantages is a simple and hassle-free account opening process for both personal and corporate accounts. Let’s take a closer look at what it takes to open a payment account in Malta.

Is it hard to open an account in Malta as a non-resident?

Opening a payment account in Malta for foreigners is generally easy. However, requirements may vary depending on the financial institution. The worst-case scenario would be a long processing time, involving the submission of various documents, needed for the digital banking provider to assess your financial history and credit standing.

For EU citizens, opening an account in Malta is relatively straightforward. However, for non-EU citizens, the process can be far more complex. Even if they pay taxes as Maltese residents, they may still be required to pay an additional annual fee simply due to their “international client” status.

What documents are required to open an account in Malta?

In order to open a current account in Malta, you will need to present the following list of documents:

- A valid passport or Maltese identification card (if you are living in Malta);

- Proof of address (e.g., a recent utility bill);

- A letter of reference from your current or previous bank demonstrating a good credit standing;

- An application form issued by the financial institution;

- Depending on the financial services provider, a good credit score and/or additional documents, such as proof of employment and income details, may be requested;

- For business accounts, documents verifying the purpose of the business, articles of incorporation, and details of the shareholders’ identity may also be necessary;

- Lastly, you must personally visit the branch and, if you are a non-EU citizen, you may be subject to a more rigorous probe.

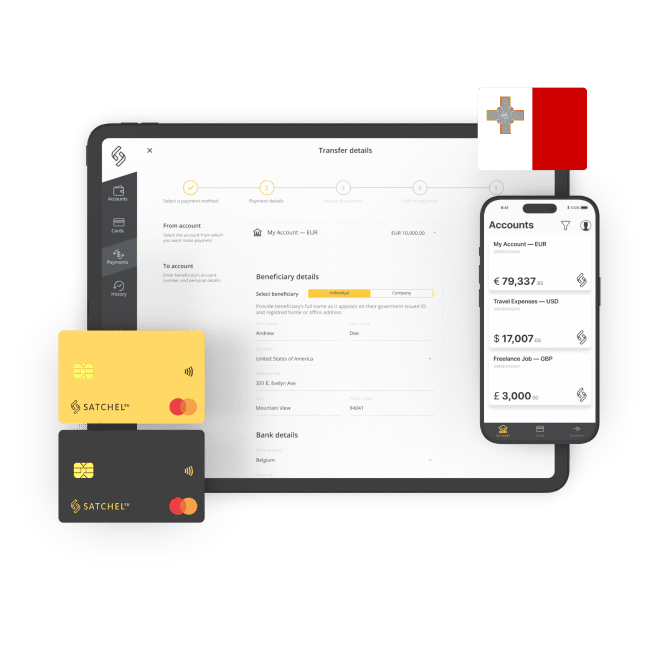

For non-EU residents, opening an account in Malta may require an additional annual fee, as well as a deposit ranging from €50 to €500 for a 12-month term deposit. Furthermore, be mindful of the fees associated with payments, falling below minimum deposits, prematurely closing accounts, ATM withdrawals, overdrafts, cheques, and international money transfers. For more cost-effective international transfers, a digital payment account with a European digital banking provider like Satchel.eu is recommended, as they offer zero-fee SEPA incoming transfers, flat fee rates for SEPA outgoing payments, SWIFT transfers, ATM withdrawals, and better exchange rates than most Maltese financial institutions. Satchel is a direct Mastercard partner, meaning you can order virtual or physical payment cards and have them delivered to your doorstep.

If paperwork and in-person visits are a hassle for you, then a business or personal multicurrency account is the perfect solution. You don’t even need to fly to Malta, unless you want to combine business with pleasure and enjoy a nice stay by the seaside!

How long does it take to open an account in Malta?

Opening a payment account in Malta can take several months of processing as local financial institutions must carefully examine your entire banking history, documents, and credit records before granting you an account. You will have to go through this process even if you are an EU citizen under the protection of EU regulations.

What is the best method to open an account in Malta?

If you need to open an account quicker, you can do so online. Malta is widely known for being a sophisticated European jurisdiction for fintech, as recently evidenced by the results of a research study released by McKinsey & Company. However, if you have the time and it’s not urgent, you can always fly to Malta or hire a legal firm to do the paperwork for you – luckily, English is one of the two official languages, so it won’t be an issue. There are plenty of financial institutions and online banking options to get a European IBAN online! Visit Satchel’s official website to learn more!