What is a B2B Payment: Definition, Methods and Explanation

The global B2B payments market is forecasted to grow at a compound annual growth rate (CAGR) of 10.2% through 2028, from $903.5 billion in 2021, up to $1.6 trillion in 2028. The world of business to business transactions is not just lucrative, but also complex and sophisticated. You can think of them as a one time or recurring transaction between the client business and the supplier.

Unlike B2C transactions, these are a lot more structured and involve different nuances that influence the process. These payments usually require more time to approve and execute the transaction (typical B2B invoices take over 14 days to process, according to PYMNTS), depending on the amount, currency, jurisdiction, and supporting documents. While all of us can enjoy instant contactless payments as consumers, business transactions require more effort and precision.

How are B2B Payments Different from Other Payments?

Let’s dive deeper into B2B payments to bring more clarity into the picture. Here’s some key points that make B2B payments different from other types of payments, such as B2C and P2P:

- Business to business payments are often regulated by complex contracts;

- Tax, VAT, and GST payment information all need to be tracked for reporting purposes;

- B2B payments require longer processing time;

- Payment methods for businesses can be limited or restricted due to compliance reasons;

- Companies need to make projections and track all details of international payments.

How does Electronic B2B Payment Processing Work?

There is a wide variety of business payment solutions present on the market that address different company needs. While B2C transactions are mainly processed electronically, a great part of B2B companies still rely on paper checks and ACH transfers. This is due to complications with redefining procedures and systems that have been in place for years for electronic transactions. Yet, Gartner predicts that by 2025, 80% of B2B transactions will be digital.

Why Do Companies Use B2B Payment Gateway Software?

To streamline B2B payments, companies are starting to leverage innovation and technology to put in place efficient payment systems. This became an absolute necessity with the global boom of e-commerce, forcing businesses to set up payment gateways that allow them to process transactions through the established cycle:

- Purchase initiation

- Purchase order issue and approval

- Invoice generation

- Payment execution

- Receipt issue

What are the Most Popular Methods of B2B Payments?

Just like consumers shopping online or in-store, businesses have multiple options to make payments. Some of these are more seamless and effortless, while others are not so hassle-free. The ultimate choice depends on a variety of factors, such as speed, cost, convenience, and security. In other words, you want to make sure the money gets from point A to point B in the most reliable way possible. Over the last decade, B2B payments have greatly evolved thanks to the advancements in digital banking, the rise of fintech companies, as well as evolving fraud schemes and labor shortages that contributed to the development and adoption of more effective and improved solutions.

Ideally, your B2B payment infrastructure should allow for multiple payment methods, but it can help to know which options are out there. The most common means for business transactions at the moment are wire transfers, credit cards, ACH payments, digital payment platforms, cash, checks, and e-checks. Each one of these comes with its own advantages and drawbacks, and our task here is to explain to you what are the differences between them.

Wire transfers

This direct payment method is a convenient and secure option for companies that operate globally to send and receive payments for goods and services. By logging into your corporate bank account and inserting all the invoice details, you can easily make a payment online. Moreover, with mobile payment apps that most providers offer, digital payments are becoming even more reliable and simple.

Credit cards

Just like consumers, businesses often use credit cards to make payments due to their convenience and frictionless process. According to PYMNTS, the B2B virtual card payment market is expected to reach $553 billion by 2024. By simply entering the card and company details in the payment form you can easily take care of a recurring or one-time payment. Yet, this option can be quite costly when it comes to larger transactions, as the fee you will have to pay can go up to 2-4%. Read how to choose a virtual card for your business.

ACH Payments

Automated clearing house payments are electronic payments that have recently gained popularity in the USA. In fact, the National Automated Clearing House Association has reported that their network processed 24.7 billion payments in 2019 alone. According to the projections of NACHA, the positive trend of ACH payments suggests that they will soon account for half of all B2B payments in the American economy. This method allows businesses to perform direct, secure, and automated payments, transferring the amount due directly from their account.

E-checks

Also referred to as direct debit, this option is similar to the good old paper checks (which still account for about 42% of all corporate transactions), but, of course, simpler and cheaper than its predecessor. E-checks use the automated clearing house network to execute payments, but they are different from actual AHC payments. They are overall a much faster option than regular checks, but still require quite a few steps for processing.

Digital Payment Platforms

Various online B2B payment platforms offer their customers a possibility to open an account remotely and transfer funds internationally with ease in multiple currencies. The best part about these is the speed and centralization – you can transfer funds directly from the provider’s app or web client office in minutes, tracking your transfer’s status with real-time PUSH notifications. Finally, security and customer service shouldn’t be overlooked. When you’re making a B2B payment through a digital platform, you can be sure that the security tools and procedures your provider is using are in compliance with current regulations; and in case there is an issue, the customer support team will always be there for you.

Paper Checks

You might be surprised, but some 40% of all B2B payments in the USA are still made via check, according to PYMNTS. This means that about 81% of businesses prefer the old-school way to settle invoices, despite the rapid digitalization of the B2B payment industry driven by the post-pandemic needs. Such strong reliance on paper checks exists mainly due to the confidence and convenience that comes with this habit. There is little you can do wrong after using checks for decades and knowing every nuance of how they work. This, along with high traceability and extended depositing time frame, is exactly what keeps paper checks alive.

Cash

In some cases, cash is the best method to make a B2B transaction go through in a fast and seamless manner. By using cash, businesses can avoid recurrent annual fees present in other B2B payment methods, such as a line of credit. In addition, there’s no need to pay interest unless the money is actually spent, which helps keep transaction expenses to a minimum. In fact, some companies only accept cash payments to avoid late fees and other inconveniences. However, such payments must be treated with caution to keep the cash flow balance positive.

The Issues of B2B Payments

Despite all the advantages brought by digital B2B payments, there are still a number of issues that companies worldwide continue to face.

The choice of payment method

Having a lot of options to choose from is not always an advantage. Digital coins, checks, wire transfers – the possibilities are countless and due to different approaches adopted by companies you may not always find your preferred payment method among the ones accepted by the vendor.

Transaction security

Cyber threats are real, especially when it comes to such a sensitive process as payment data treatment. Breaches, scams, fraud scenarios – all of this must be accounted for when it comes to B2B payments. In 2021 alone 49% of businesses have faced payment fraud attempts. To avoid falling into hackers’ traps it is important to ensure that your digital payment provider has all the necessary security certifications and complies with current legislation and regulations.

Transparency

To manage cash flow and avoid process disruptions, it is fundamental for businesses to be able to track the transaction route and status in real time. Lack of visibility can lead to broken business relationships with clients and suppliers, inefficient financial statements and other detrimental consequences.

Execution timing

B2B transactions can be time consuming due to the complex processing algorithms, need of supporting documentation, and other nuances. Yet, in business a lot depends on how fast your supplier receives the payment and delivers the resources your business operation depends on. B2B payment processing can take more than 40 days, depending on the payment cycle.

Fees

The cost of transaction, as well as account maintenance, are essential factors that businesses take into consideration when choosing their payment provider. They are usually reluctant to send / accept wire transfers or credit cards, as those come with significant fees. The aversion to use payment methods that are more costly also changes depending on business size.

Trends in B2B Payments

The outbreak of Covid-19 forced businesses to shift their focus to digital and contactless payments, both in B2C and B2B cases, addressing the fact that 87% of customers prefer touchless transactions. As a result, they were able to stabilize revenue and keep their businesses stable during uncertain times. Now businesses use automation solutions and additional APIs to allow for more payment options and make the process more efficient overall.

Among the key trends in the B2B payment industry we can define:

- Mobile payments

- Real-time transactions

- Automation

- Innovative security tools

What to Look for in a Payment Provider?

Choosing a B2B payment method and provider is rather different and complicated compared to your experience as a consumer. In fact, finance departments in companies usually don’t get enough credit for the everyday struggles they have to deal with. But, as mentioned earlier, the fintech market is currently offering numerous attractive tools for efficient and seamless B2B payments.

Satchel.eu

Satchel is a leading European EMI, with HQ in Lithuania, performing international money transfers, payment infrastructure, fintech consulting, currency exchange, BaaS, SaaS, and card services since 2018. We create flexible, secure and convenient money management solutions for private and corporate clients.

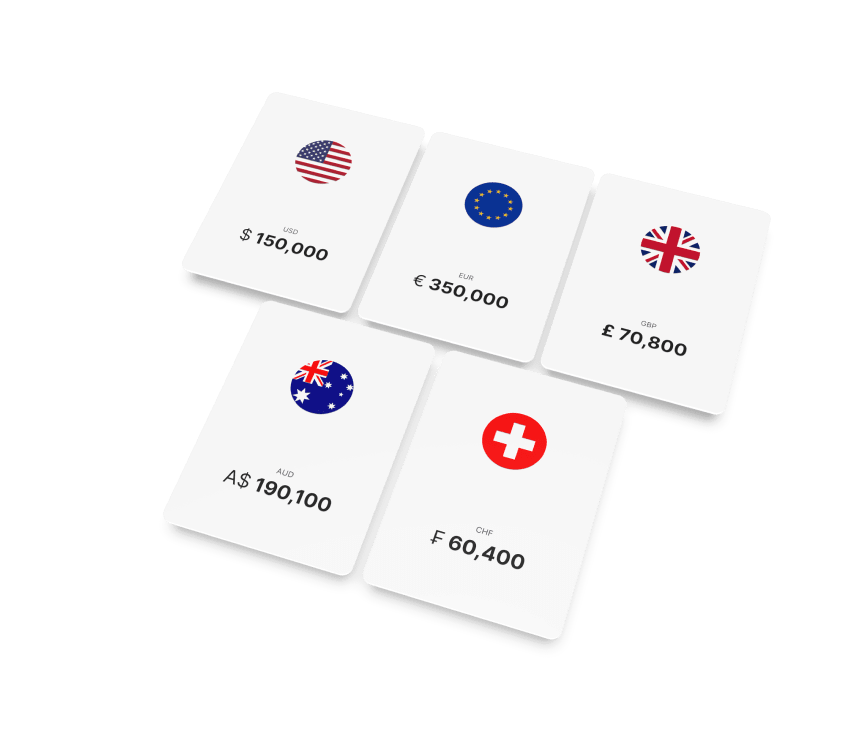

With the Satchel payment infrastructure you can forget about costly and complicated B2B payments and take care of your transactions in seconds via the dedicated app or web client office. No matter where your business is located, what currencies you use, or how often you transact, our solution will be a great fit. Here are some benefits:

- Remote account opening

- 36+ currencies supported

- SWIFT and SEPA transactions with European IBAN

- Virtual or physical Mastercard cards tailored to your needs

- Security ensured by 3D Secure, 2FA and other tools & policies

- Currency exchange at best rates

- Personalized tariff plans

- Responsive support team

Fundbox Pay

Fundbox allows sellers to receive instant payment on an invoice, while buyers can postpone up to 60 days to make a payment. Fundbox applies a processing fee of 2.9% and offers checkout functionality for B2B e-commerce and wholesale business.

Paypal

Paypal creates flexible payment solutions for B2B, allowing companies to bill their clients via email or online invoices. By sharing their link with customers via email, messenger, or social media, companies can get paid in a fast and hassle-free way.

Square

Square offers a number of B2B payment solutions for small, medium and large businesses, including credit card transactions with a 2.75% fee.

Quickbooks

Focused on small companies, Quickbooks provides payment solutions and accounting software that are often used in a combo. Thanks to automation processes, incoming and outgoing payments are synced with the company’s accounting statements, making bookkeeping and tax operations simple and efficient. For credit card transactions, Quickbooks applies a 2.9% fee.

Due

Due users get a payment solution that includes electronic invoicing, digital wallet, mobile payments, project management, and time tracking. The fees start at 2.8%.

Conclusion

The advancement of B2B payments technology has improved business operations for companies worldwide. Business transactions are complex and depend on numerous nuances, but automation and digitalization make life simpler for company owners. With smart and convenient B2B payment solutions for any needs, your business is set for success.