Current account for a freelancer: all you need to know and useful tips

A traditional 9-to-5 office job can offer employees many benefits, among which a sense of stability, clear career trajectory, and community. Yet, more and more people hand in their “I quit” letter, sacrificing the perks of a steady office routine to work independently. According to Upwork’s 2021 Freelance Forward survey, the freelance workforce in the U.S. alone has grown by 3.7 million workers since 2018. Unplugging from a traditional career has become particularly attractive in the context of the Great Resignation, where people no longer seem to tolerate the daily commute, stress, and burnout that come with office work, and choose flexibility and a healthy work-life balance instead. If you are thinking about it, read our article on registering as a freelancer.

But the grass is always greener on the other side. While the freelance lifestyle clearly gives a greater level of autonomy and control over one’s own life, it also comes with a bunch of challenges like unpredictable workloads, time management complications, and financial headaches. You technically become your own boss, which increases responsibility, expectations, and makes your to-do list significantly larger. One of the first obstacles many green freelancers face is opening a freelancer current account.

Can a freelancer open a current account?

It would be more challenging to answer the opposite question – can a freelancer survive without a current account? The answer is no. We live in a digital and cashless world, which makes it hard to be efficient without a reliable digital channel to manage your incoming and outgoing transactions. This is particularly true for freelancers, who rarely limit their operations to a single geography and have to manage relationships (including financial transactions) with multiple international clients.

So, what kind of current account does a freelancer need? A business current account with attractive fees and a possibility to issue a payment card for online, in-store purchases and to be able to get paid as a freelancer.

What to look for in a current account for freelancers?

You could definitely just google “best freelancer current account” and go with the first link. But if you’re not the kind of person that likes to trust the law of chance, we have a better option for you. The best way to get what you want is to know exactly what to look for. Let’s start with defining the key purposes of current accounts for freelancers:

- Bookkeeping. As a freelancer, you will have to report your income and expenses to the relevant authorities of your jurisdiction, and pay taxes, including the one for self-employment. Opening a separate current account will help you manage your earnings and expenses, as well as budget for taxes and other necessary spendings. Bottom line – a current account will make bookkeeping easier for you.

- Professional image. As a rule, clients prefer to pay invoices to a business rather than an individual. You, therefore, need a current account to provide its details every time you send an invoice to a customer.

- Business loans. Managing your cash flow might be challenging, especially at the beginning of your freelance career. You are never insured from a client paying your invoice late (or just disappearing into the void). This means you might have to get a small business loan to balance out your cash flow. Lenders usually require a business current account statement in order to evaluate your case and make the final decision.

We’re clear with the purpose of the account, but what exactly does one need to look for when choosing a provider? To manage your money like a pro, make sure your current account provider has all of the following:

- Remote account opening

- Minimal documentation requirements

- Access to account via web and mobile app

- High-level account security

- Payment cards

- Transactions in multiple currencies

- Digital invoicing

- Transaction overview feature

- Responsive customer support

- Low monthly fees

- Low minimum balance requirements

Quite a checklist but all of these are important and will greatly simplify your self-employed life.

How do I open a freelancer current account?

No matter what provider you choose, the account opening procedure will be standard with slight variations. You will mainly need your personal ID and business details (and for some providers that will be sufficient), with some additional documentation that can include the business plan, recent tax returns, and a forecast of your cash flow.

When it comes to the choice of the provider, it all depends on personal preferences. You can open an account with Citibank, Chase Bank, Unicredit, Barclays, or any other well-known traditional bank. But given that big banks come with [big] expectations, requirements, and paperwork, there’s also an alternative – digital banks or electronic money institutions. Unlike some might assume, your money is safe at all times when you deposit it with N26, Revolut, Monese, Wise, Satchel, or any other digital institution. All of them have been issued a financial license, which protects the deposits of users and ensures full compliance of providers and adherence to industry regulations, best practices, and security measures.

The main difference between an electronic money institution and a traditional bank, is that the accounts are opened faster, the customer service is better, and the user-experience is superior.

How to open a freelancer account online with Satchel?

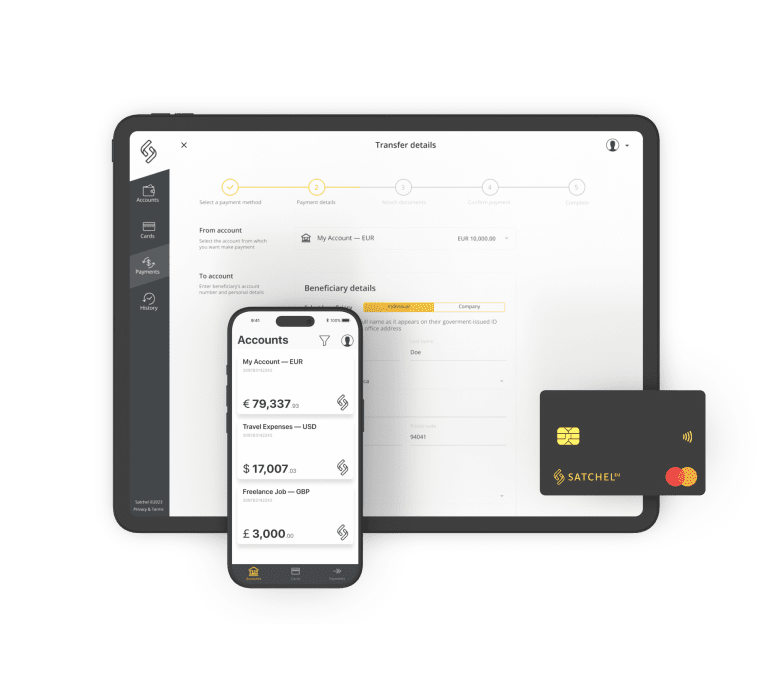

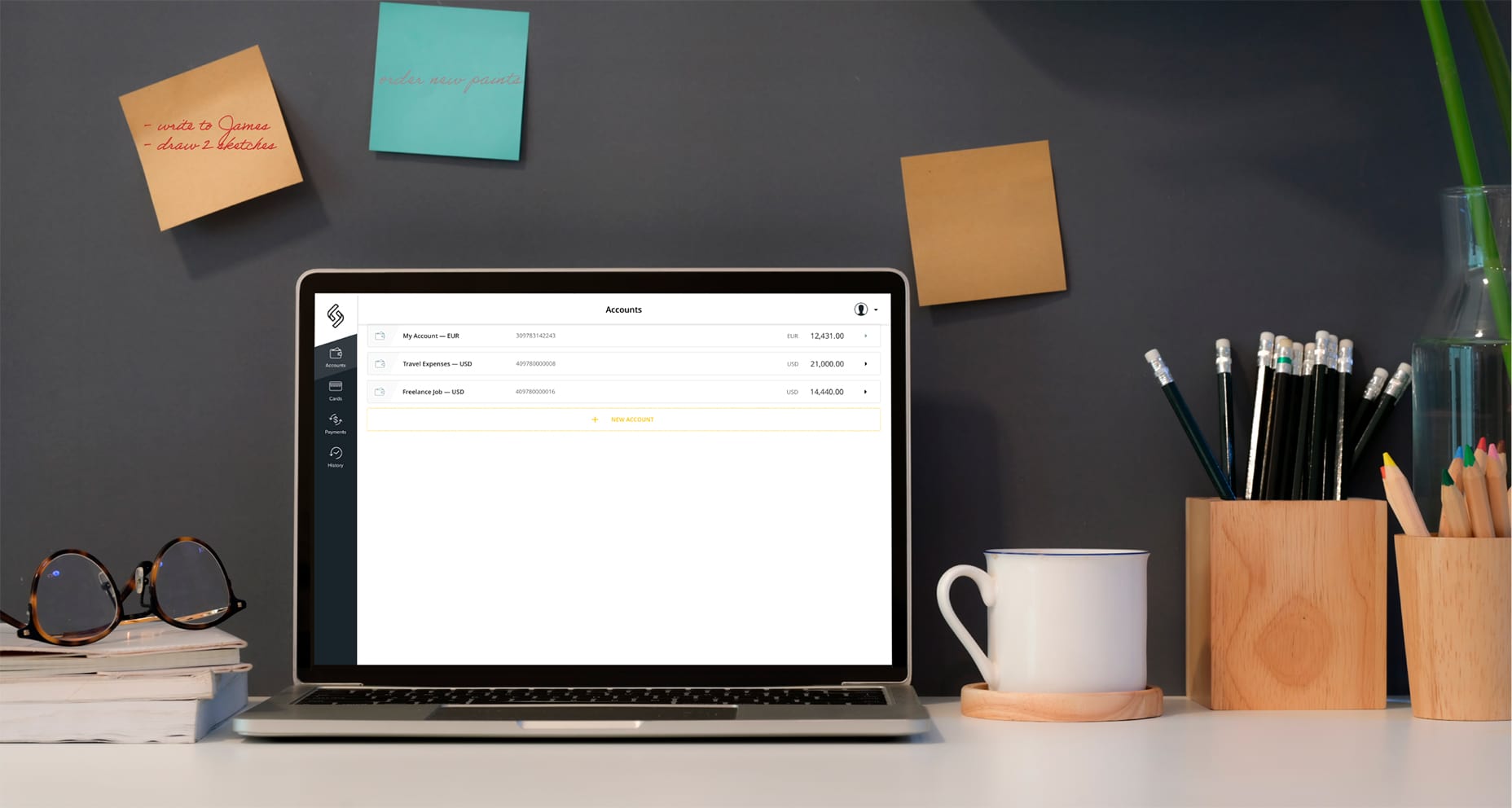

Satchel is a leading European EMI, with HQ in Lithuania, performing international money transfers, fintech consulting, currency exchange, BaaS, SaaS, and card services since 2018. We create flexible, secure and convenient money management solutions for private and corporate clients.

With Satchel you can forget about complicated money management and take care of your business expenses directly from the dedicated easy-to-use app or web client office. Whether you work 100% online or rent a table in a coworking space, whether your clients are located in Europe or all around the world, our solution will allow you to:

- Open an account remotely with just two personal documents

- Get a unique European IBAN

- Transact via SWIFT and SEPA

- Get a virtual or physical Mastercard tailored to your needs

- Sleep well, as your money is protected by 3D Secure, 2FA and other security tools

- Enjoy currency exchange at attractive rates

- Choose a personalized pricing plan

- Communicate with a responsive support team

All you need to do to open a business or freelancer current account with Satchel, is fill out the online application form, attaching basic documentation. We will process the application remotely within 1-3 business days and get back to you as soon as all the checks are done.

We have added a freelance current account to our product range because we know how hard it can be to start a new chapter in your life. We want to do our best to support your everyday financial decisions as an entrepreneur and set you up for success, enabling you to do what you love most, while we take care of the rest.